Family-Owned Bankruptcy Law Firm

FREE CASE EVALULATION

Fields marked with an * are required

Too much debt? Let us help!

Step 1: RESTART

by Getting Relief from your Debt

Step 2: REBUILD

your 720 Credit Score!

Step 3: RESTORE

your Joy and Hope for the Future!

Why Choose O’Bryan Law Offices?

Here is what our clients say…

“I was losing sleep and sank into a deep depression over my bills. I was paralyzed in my own house and I couldn’t face the knock on my front door by the sheriff serving me papers. I thought that bankruptcy would be the worst thing in the world, but instead I can wake up each day and face life without fear and worry. After filing bankruptcy with O’Bryan Law Offices, I felt a huge burden lifted off of my shoulders and I was able to keep my home. I feel very GRATEFUL to all the staff that pulled me through this tough time and encouraged me.” – Carl S., Louisville, KY

“Don’t believe what people tell you. I saved my house after people told me that I would have to give up everything I owned. Every situation is different and I am on my way to a better future. It was simple and fast. My paralegal was great and made me feel good about my next step, “life after bankruptcy”. My kids can tell a difference in my happiness and I can be a better parent. Julie and her staff handled all my problems and are very compassionate. I appreciate all you’ve done for me and my family.”– David H., Louisville, KY

“The creditors and collection agencies were driving me crazy. Calling day and night and using scare tactics that made me live in fear. They called me at work and called my family members. I felt ashamed and confused. It made me so mad and my boss wasn’t too happy either. I was fed up and knew that I needed to change things. I looked around for attorneys and felt the most comfortable after my first free consultation with O’Bryan Law Offices. What a difference the right lawyer makes? Everyone was positive and treated me with dignity and respect.”– Roger H., Upton, KY

"Debt once controlled me, but after working through my bankruptcy with this talented firm almost two years ago, my finances are now on a very solid foundation. They shined a light within the darkness of insurmountable financial disaster, striving to provide comfort in a turbulent time. Every dollar spent, every mile driven, every minute of your time mattered to them. They were familiar with questions both obvious and not so much, upfront and clear, kind and friendly. I'll always think of the experience positively, almost dreamlike. I have since "gotten out from under," reestablished control of my future, and I get the most for my hard work. My financial and spiritual resurgence would not have been possible without the guidance of these very respectful and caring folks. I'll always be thankful for them, and I know there's a good chance that if you're pondering bankruptcy as a solution and are reading this, you'll eventually feel the same way."

-Josh B.

Previous

Next

Experienced Bankruptcy Lawyers

Here is what makes us different…

Legal issues can make life feel chaotic. For that reason, we make it our job to put you back in control.

The experienced lawyers at O’Bryan Law Offices do that by helping you regain financial independence in bankruptcy. We can also assist you when your circumstances call for an uncontested divorce, estate planning and personal injury representation.

- Julie has been Board Certified in Consumer Bankruptcy since 2003

- Over 40 years of combined Bankruptcy experience

- Filed over 25,000 Chapter 7 and Chapter 13 cases

- Helped over 30,000 families get a fresh financial start

- 10 Rating on AVVO for Julie O’Bryan

- Recognized as a “Super Lawyer” multiple years in Bankruptcy

Here is how we can help you:

Practice Areas

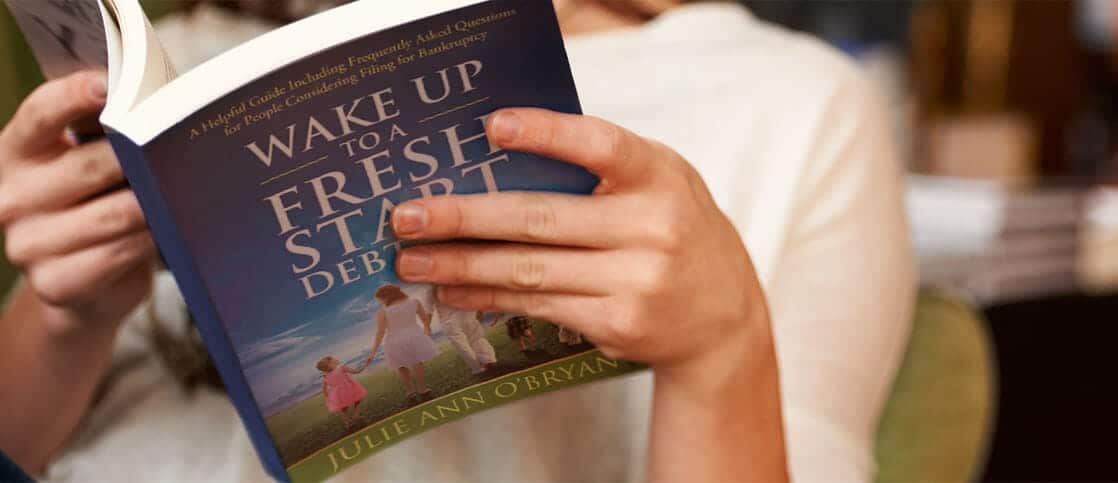

Wake Up To A Fresh Start, Debt Free

A book written by our very own, Julie O’Bryan